Chris Knox in the NZ Listener with a position taken by most in the New Zealand music community - Chris Knox collection

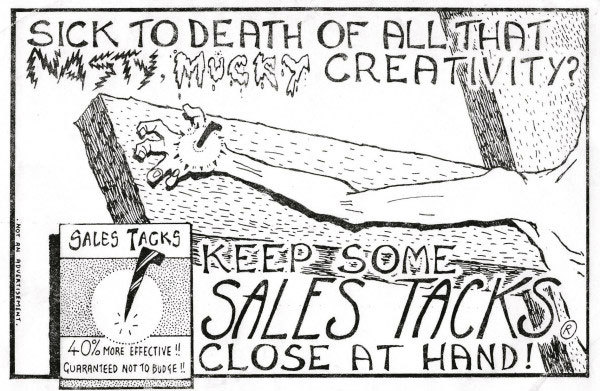

Sales Tax doubles, music industry squeals

The Sales Tax imposed by successive governments on the sale of recorded music from the mid-1970s through to the mid-1980s was controversial and widely regarded as damaging to the local recording industry.

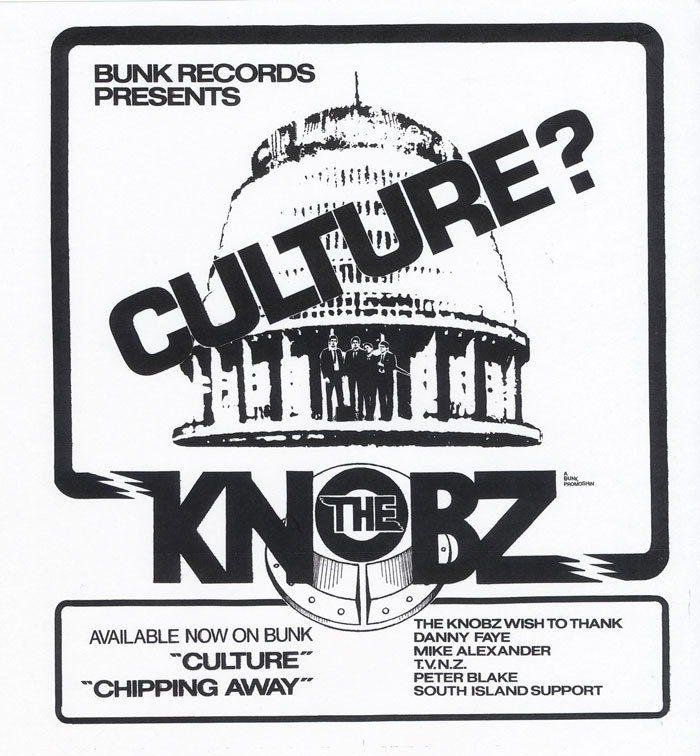

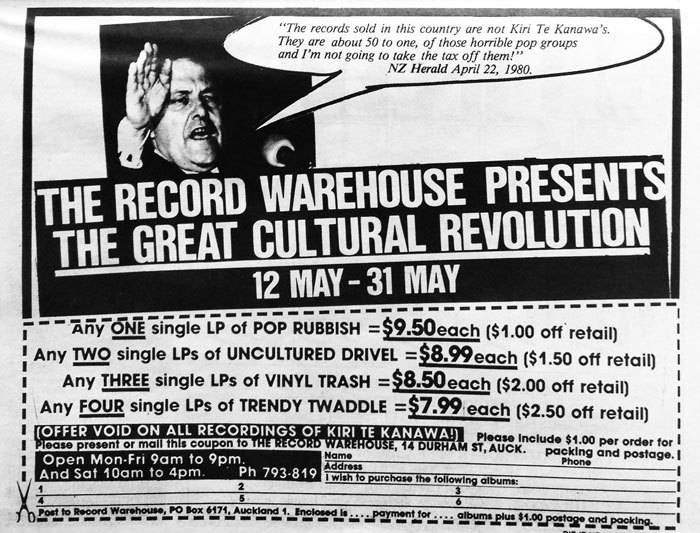

Many people recall Prime Minister and National Party leader Rob Muldoon as being closely associated with the sales tax, which targeted the sale of the media – records and cassettes. He made numerous jibes in the media aimed at local pop music, repeatedly refusing to drop the sales tax despite industry lobbying, and even found himself being parodied by new wave band The Knobz in their hit single 'Culture?'.

The advert for The Knobz single Culture?

However, it was the previous Labour Government that raised it in 1975 from 20% to 40%, and it was a Labour Government that cut the tax back to 20% in 1984, before introducing 10% GST in October 1986.

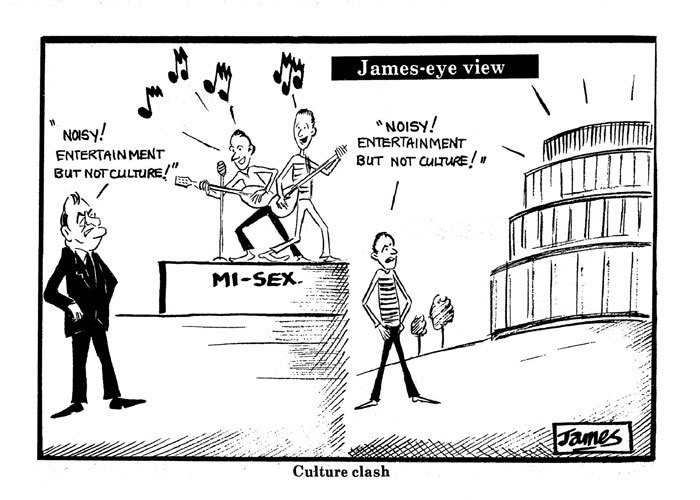

James Lynch cartoon from the Taranaki Daily News, 23 June 1980 - National Library of New Zealand

In his book Stranded in Paradise John Dix writes: “... throughout April [1980] ... an argument had been raging in New Zealand over the 40% sales tax levied on records. The Record Retailers Association, record companies, and the Arts Council all had their say, pointing out that whereas such publications as Penthouse and Playboy were exempt from sales tax, the record industry was suffering inflated prices because the Government deemed records were not ‘culture’."

Frank Shaft in RipItUp, May 1980

On April 21, Prime Minister Rob Muldoon announced, “The records sold in this country are not Kiri Te Kanawa’s. They are 50 to 1 those horrible pop groups and I’m not going to take the tax off them.” The Prime Minister was clearly of the opinion that pop music was NOT culture.

When Muldoon attended a Mi-Sex concert on June 17 1980, he emerged unmoved, and “instead of offering any tax relief [he] said he would instruct his tax inspectors to consider putting a tax on Playboy and Penthouse. To date no such tax has been applied.” (Phil Gifford, Billboard, May 9 1981).

Mi-Sex backstage 17 June, 1980, with PM Rob Muldoon and his precautionary ear-plugs. From left: Steve Gilpin, Don Martin, Kevin Stanton, Muldoon. - National Library of New Zealand

NZ On Air’s Brendan Smyth: “When I went to [to work for] the Queen Elizabeth II Arts Council in 1979, I was part of a team, along with Jim Booth and Rocky Douche from Marmalade Studios, that wrote a report [published in 1980] to the Government on "The Development Of The New Zealand Recording Industry" that made two recommendations – abolish the 40% sales tax and set up a 'Recording Commission'.

“Shortly after the report was presented, the Government abolished the sales tax on records. We flattered ourselves that it was a victory from the report but in reality, it had been long planned by Treasury as part of the transition to GST. All sales taxes, not just records, were abolished and replaced with GST.”

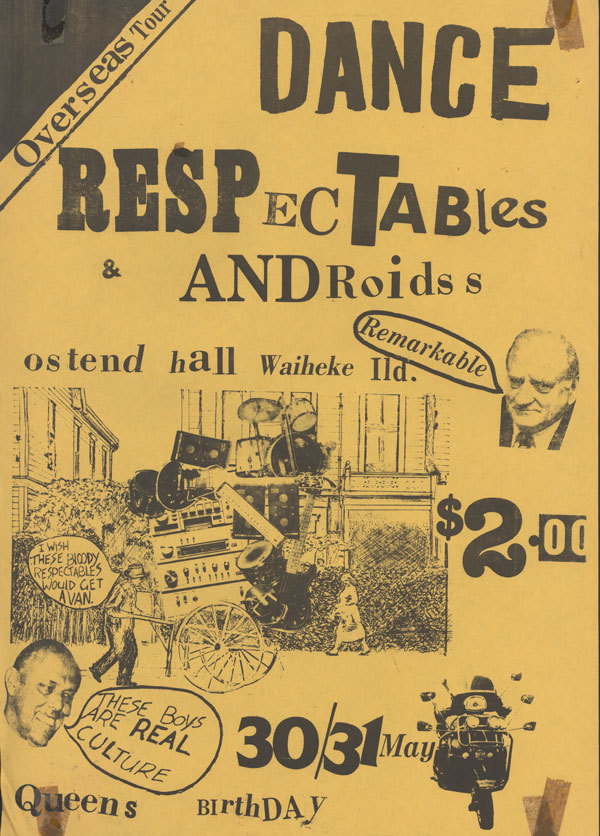

The sales tax found its way onto many band posters and fliers

Bob’s your uncle

In the book For The Record: A history of the recording industry in New Zealand, Bryan Staff and Sheran Ashley write that "In June (1975, following the May 22nd sales tax doubling), Bob Tizard (the then Minister of Finance) wrote to the NZFPI defending the new tax, arguing that the import content, once royalties and raw materials are included, was quite significant.

“Tony Chance had been appointed as executive to the NZFPI that year … Chance had returned from Britain armed with a letter of introduction to Fred Smith from EMI copyright manager Dawson Payne. Tony had a law degree, something Smith did not. With an in-house lawyer in an executive position within the industry, Smith reasoned they could attempt to redress the unfairness of the sales tax debacle …

“… The industry mounted a spirited campaign against the unfairness of the sales tax, using pictures of a New Zealand opera singer against a Playboy bunny to protest the inequalities of books versus music exemption. But Prime Minister Muldoon – perhaps still smarting from having to share an elevator with members of Osibisa – held firm.”

However, Rocky Douche says that “the government [of the day] was misinformed, they believed that all LPs were imported, so increased the tax to 40% as a way of discouraging the exportation of overseas funds. They didn’t realise that virtually all LPs were manufactured here. Only a royalty fee on international artists left New Zealand.

“Even though RIANZ (Tony Chance) and APRA (Bernie Darby) lobbied vigorously and the rest of Caucus were happy for it to go back to 20%, Muldoon personally resisted correcting the mistake for a long time. However, I think the tax was reversed well before the switch to GST.”

Don’t give me culture

When the sales tax was doubled in 1975, from 20% to 40%, did it directly affect local output? That year 50 local singles were released. The following year, it was much the same number, but by 1977, there were only 26 local singles, based on estimates from RIANZ. That is low compared to the mid-60s, with 70 to 80 singles a year by local artists.

Peter Jamieson, Managing Director, EMI NZ: “We do not have the funds to invest in local recordings...” (from the 1978 TVNZ doco Good Day - The music and record industry, director David Baldock, producer Tony Hiles).

Billboard’s NZ correspondent Phil Gifford reports (March 17, 1979) that “Largely because of the sales tax, many record companies have been struggling. In 1977 [RIANZ] association chairman Tim Murdoch estimates a $600,000 loss for the industry … EMI made no profit, and cut its staff from 400 to 270, including the loss of three full time producers...” He also notes that a five percent local quota between 6am and 9am, and 9pm to midnight was written into the rules of broadcasting four years prior, but had not apparently been enforced. However, Murray Cammick suggests, “the sales tax became an excuse for the multi-nationals to not record New Zealand music.”

The tax attracted a range of lively responses from musicians, such as Mi-Sex, who invited Muldoon to a concert in Wellington.

The tax attracted a range of lively responses from musicians, such as Mi-Sex, who invited Muldoon to a concert in Wellington, and The Knobz, who had a top five hit in late 1980 with a song called 'Culture?', aided by a music video featuring comedian Danny Faye impersonating Muldoon. The song protested the 40% sales tax by using Muldoon’s line that pop music wasn’t culture, but it failed to move the country’s leader.

John Dix: “The ‘culture’ debate was still very much in the news when Mi-Sex arrived in the country in June [1980], and not wanting to let such a golden opportunity pass, the band invited Muldoon to their Wellington concert, an invitation he accepted.

“Receiving a big cheer, the Muldoon entourage entered the Wellington Town Hall just minutes before support band The Swingers started up. Earplugs inserted, the Prime Minister sat through the concert, seemed to enjoy himself, met Mi-Sex backstage afterwards, and generally came across as a good guy. The sales tax on records, however, remained...”

Graham Atkinson was working at the concert, and says he “had the task of accompanying Muldoon and his daughter, with the police escorts, in the Town Hall and afterwards, backstage.

“Muldoon entered the circle to a standing ovation and never actually used the ear plugs. It was also a very cordial visit backstage afterwards, as the photos show and I think all the band appreciated the gesture.”

Mi-Sex keyboardist Murray Burns recalls that night, saying, "We argued that New Zealand music should be considered as culture. Muldoon said, ‘I'm going to see this cultural act at the Wellington Town Hall'. He turned up to meet us and was pleasant.

"But it was weird being on stage and looking out. The whole place was filled with people [dressed] in black with spiky hair and there, in the middle of the gods, was Muldoon and his entourage. The next day I remember waking up and seeing a newspaper article in which he'd said it was about as cultural as On the Mat, which was a wrestling show of the time." (interview by Vicki Anderson, 25 March 2014, Fairfax NZ)

Welcome to Malagasi

The report Brendan Smyth worked on, The development of the New Zealand recording industry, has some fascinating details on the size and scale of the local music industry back then.

From the report: "In 1978 the Arts Council established a subcommittee to consider the effects of sales tax on cultural products. The committee comprised of Mr Hamish Keith, Chairman of the Queen Elizabeth II Arts Council, Mr David Gascoigne, Deputy Chairman, and two members, Ray Columbus OBE and Neil McGough."

The Queen Elizabeth II Arts Council report from 1980.

The 40% sales tax on sound recordings, introduced in 1975 by a Labour Government, is described by the Arts Council as an ad hoc decision, where the tax rate on sound recordings was increased from 20% to 40%. "With the exception of the Malagasi Republic, no other country appears to compare with NZ's 40% sales tax on records."

The nearest competitor to this number was Israel, which at that time had recently dropped its tax on records to 30%.

Australian figures showed that "the cost of producing a record in a cover is under 75% that of the equivalent cost in NZ, but that Australian companies receive a 50% higher return that their NZ counterparts. This lower return to the NZ company is, without a doubt, markedly influenced by the effect sales tax has on the retail price in NZ."

The report says that the sales tax generates approximately $8 million in taxes annually. At the time of the Arts Council's report in 1980, they state that "the manufacturing industry in NZ is dominated by 6 major record companies. The sales of these companies account for over 90% of local record sales."

Those companies were CBS, EMI, PolyGram, RCA, WEA, and Festival Records, described as being jointly owned by Kerridge Odeon, the NZ shareholder, and Festival Records Australia, a subsidiary of News Ltd, Australia. It also mentions labels that focus on New Zealand artists, like Viking, Kiwi, Music World, Zodiac, Mascot, Impact, Moon and Stetson.

"Altogether 340 people are currently employed in the industry. In excess of 90% of all records sold in NZ are manufactured in NZ at pressing plants owned by EMI and Polygram.

"In 1978 total funds employed by the industry totaled $15 million, to produce just under 5 million albums and about 1.6 million cassettes, made up of about 1500 new titles. It must also be remembered from a retail point of view that some 8000 titles remain on release in addition to new titles. This represents a major cultural force."

At that time, a total of only six percent of the recordings sold are by local artists. The report notes that "in recent years the variety of NZ recordings produced has narrowed, and that growth and stability of the production industry as a whole has suffered.

“This can best be exemplified by the experience of one company which some five years ago had 15 artists on contract and two producers. Today there are 4 artists without the benefit of a full time local product manager."

The report discussed the costs of recording local artists, noting that "The recording of a popular LP is likely to take 250 hours of studio time, and overseas albums frequently have production costs of over $100,000. There are a number of recording studios in NZ, at least three of which are international standard, with a capital value in excess of $3 million.

“Notable are EMI, Marmalade, Stebbing, Mandrill, Harlequin and Mascot ... Even though the facilities of NZ studios are world class, the hourly rate at about $60 is significantly cheaper than the Australian equivalent of $90 and the US of about $150."

"The cost of importing a master tape of an overseas recording is about $200. The all up production cost for a NZ album could range from $300 to $15,000 ..."

In 1975 the retail price of records went from $6.60 to $7.50, following the introduction of sales tax. In 1977 the retail price rose to $7.99, and in April 1979 it rose again, to $8.99. The report notes that "as a result of recent financial returns, some companies have further increased prices to a retail price of $9.99 ... there has been little growth in the industry over recent years."

Taxing issue

Prior to the introduction of a standardised goods and services (GST) tax of 10% in 1985, the set rate for various taxes appears pretty arbitrary.

In 1974 The Customs Act Amendment has 18% tax for mouth organs, 20% for organs, and no tax for pipe organs, presumably because the only place that bought them were churches. The tax on record players and tape decks was 56%, and the tax on LPs and cassettes was 20%. Until Labour doubled it the following year.

When Muldoon was PM and Finance Minister, the range of random taxes he introduced seems to have been endless. In 1980 he increased taxes on boats, caravans, and pottery, which effectively killed off our local caravan manufacturers and boat builders. The potters got lucky, as Customs Minister Hugh Templeton went into bat for them and got an exemption.

From NZ Parliamentary Debates, Vol 430, June 12 - July 8, 1980: Hon HC Templeton (Min of Customs): “Despite claims to the contrary, production figures have increased in recent years, from 5,600,000 tapes and records in 1977, to 6,600,000 in 1978. In 1979, 9,100,000 were produced in a country with a population of about 3,000,000. Sales tax on recordings is a major revenue earner. The tax on a long-playing record is $1.84, which represents roughly 20% of retail price. That is not exorbitant.”

Templeton then asked if the Labour opposition was suggesting some other form of tax to make up for the $9 million gained from the sales tax on LPs.

During that debate, opposition member David Caygill said “... members certainly know how much chaos that rate of taxation is causing. Members also know that pressure has been put on the Government to have it amended … the only conclusion the House can come to is that, notwithstanding the Prime Minister’s visit to Mi-Sex, he still does not understand the distinction between cultural records and other records.”

In April of 1980, Templeton had received a delegation from the recording industry, but had told them “the Prime Minister had a good case for maintaining the 40% sales tax on records because of a difficult Budget situation” (Auckland Star, Monday April 21, 1980). While Caucus may have been open to the industry's lobbying, the Prime Minister was set in his ways, it seems.

Rogernomics arrives

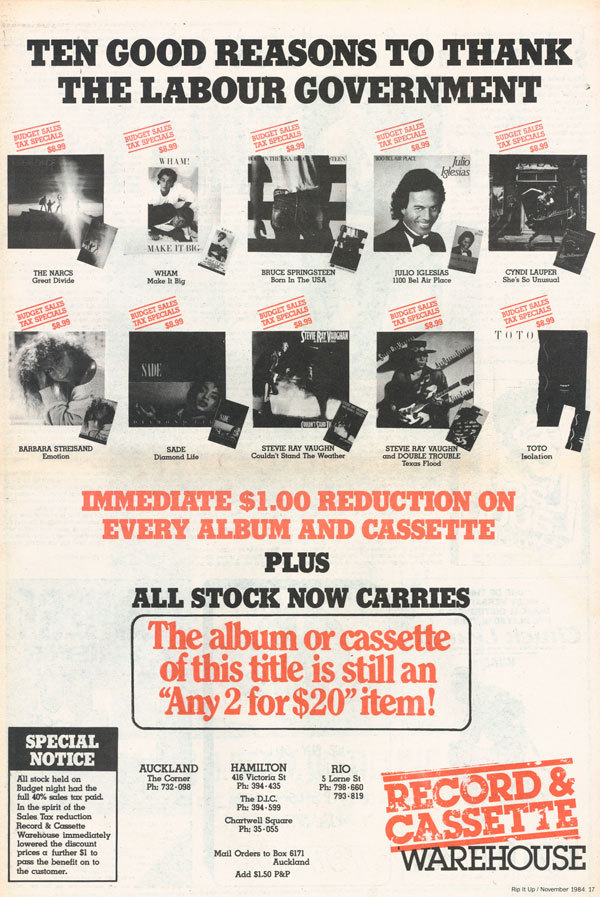

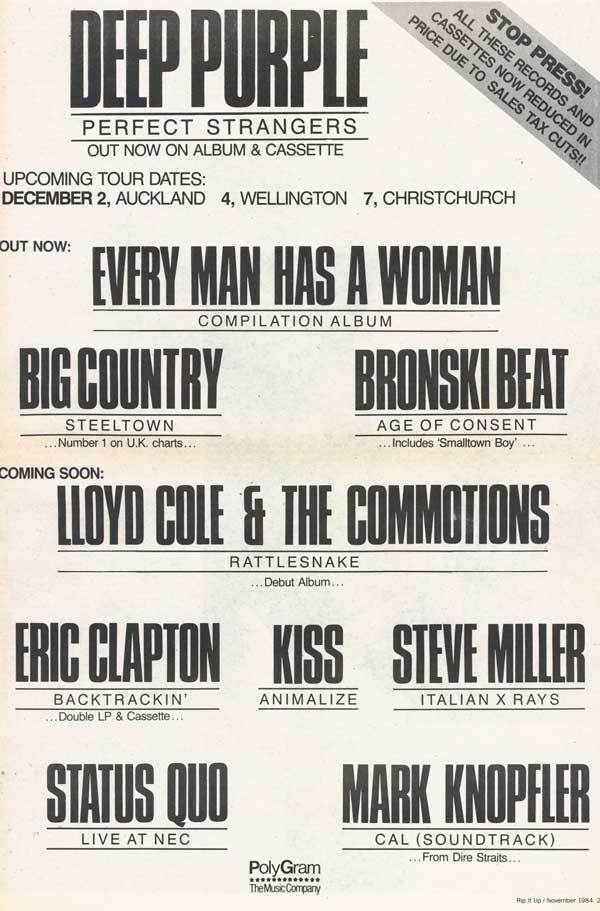

Roger Douglas delivered his first budget as Finance Minister in the fourth Labour Government on November 8, 1984. One of the moves that greatly pleased the music community was reducing the sales tax on recordings.

RipItUp reported in its News column of the November 1984 issue that “With lower Record Tax, all record companies dropped the wholesale price of LPs by $1 the day after the Budget but some retailers will keep their prices the same, citing higher freight costs to be covered. It will be a matter of ‘aggressive discounters’ becoming more active on a wider range of records, according to industry sources. The halving of the sales tax from 40 to 20 per cent will make it easier for companies (particularly indies) to cushion the blow of upcoming production cost rises…”

Record Warehouse took out a full page ad in the same issue, plugging their “... immediate reduction of $1 on every album or cassette…” The ad headline reads “Ten good reasons to thank the Labour Government” with 10 albums listed under that, including Julio Iglesias, Bruce Springsteen and Wham!

The sales tax is cut and the industry responds

Roger Douglas, delivering the Budget: “The rate of tax applying to records, recorded tapes, blank magnetic tapes, and cosmetics will be reduced from 40% to 20%. The rate applying to caravans and boats will be reduced from 20% to 10%. These changes are estimated to reduce revenue by $14 million in 1984/85, and $14 million annually thereafter.” (p1432, November 8, NZ Parliamentary Debates Vol 458, 4 Oct- 8 Nov 1984)

The parliamentary debate that usually follows the reading of the budget threw up some gems from the former PM and Finance Minister, Rob Muldoon. After losing a snap election in July, he had some definite ideas on what the Labour Government was up to with the economy and what he thought they should be doing.

When the Budget was tabled, Muldoon started in on the increase on the tax on alcohol ...

Muldoon: “Although this bill taxes liquor at about twice the increase the National Government had in mind, it does give a savage blow to the wine industry, and quite a light tap to the brewers."

Prime Minister David Lange: "A light tap is quite a nice drop."

Muldoon: "Yes, and nothing at all to those who drink water, as the Prime Minister does."

Lange: "I commend water to the Leader of the Opposition."

Muldoon: "I use it for its proper use – washing."

Lange: "No one would guess." (p1442, November 8, NZ Parliamentary Debates Vol 458, 4 Oct- 8 Nov 1984)

Discussion included criticism of Labour only reducing the sales tax on boats and caravans, with Social Credit MP Gary Knapp spinning that the public had expected them to be removed, rather than reduced, based on Labour's pre-election promises to remove tax anomalies.

Anne Fraser (Labour MP, East Cape) … “The 40% sales tax was imposed on the record industry in May 1975, and the following years have seen the record industry stagger under the heavy load of that tax. Between 1974 and 1975 the number of records made decreased by 17 % in 7 months. In 1983, 6,800,000 records were pressed – an increase of only 30% in eight years … The Labour Government has already made a commitment to ensure that a greater volume of local content is broadcast on both radio and television...” (p1463, November 8, NZ Parliamentary Debates Vol 458, 4 Oct- 8 Nov 1984)

On the following Tuesday, November 13, a few days after the Budget had been passed, the post-Budget debate resumed in Parliament. By the time it concluded, at the end of November, Rob Muldoon would be gone as National's leader, replaced by Jim McLay.

Muldoon: “... Last night the Prime Minister and I were both at the music awards. The Prime Minister was greeted as a hero, and he had a little quip … he said that taxes were like clothes: they were more fun to take off than to put on. There was loud applause. It was an upbeat quip. Taking the tax off records is good for young people, but putting up the price of milk by $30 million is bad for babies. The Government has taken the tax off records and the subsidies off milk. What kind of caring Government is that?” (p1648, November 13, NZ Parliamentary Debates Vol 459, 13 Nov- 5 Dec 1984)

Related links and video

Graeme Atkinson: Rob Muldoon goes to Mi-Sex concert

The Knobz - 'Culture?'

Good Day - The Music and Record Industry, part one (1978)

Good Day - The Music and Record Industry, part two (1978)